How to Use Our Salary Calculator: A Step-by-Step Guide (FY 2025-26)

Why I Built This Salary Calculator — And Why You’ll Want to Use It

Recently, when I switched jobs, I found myself juggling spreadsheets just to estimate my exact monthly in-hand salary. The offer letter listed a shiny annual CTC, but the net amount hitting my bank each month depended on PF contribution, NPS choices, professional tax, deductions, and occasional variable bonuses. Most online tools oversimplified this. So I built a salary calculator that mirrors a real Indian payslip month by month instead of giving a single vague annual figure.

The goal? Let you test different PF bases, toggle gratuity, add or remove NPS, include bonuses on specific months, and instantly see how regime choice (old vs new) alters real take-home. If you’re weighing two offers or planning a switch, this removes guesswork and gives clarity.

Key Takeaways

- CTC isn’t cash: employer PF, gratuity, insurance reduce monthly credit but are long-term benefits.

- Regime choice (old vs new) shifts net pay more when deductions exceed roughly ₹4–5L.

- Bonuses create spikes—mapping them month-wise helps budget better and plan investments.

- NPS employer + personal (80CCD(1B)) can boost retirement corpus and affect regime decision.

- Offer comparisons should be done post-normalizing monthly net, not just headline annual CTC.

- Always verify payslip structure—Basic should ideally be ≥50% of fixed for provident fund health.

Let's walk you through how to use our Salary Calculator the right way.

Understanding CTC Structure: What to Enter in the Salary Calculator

Every company designs their CTC (Cost to Company) differently — and that's where confusion begins. While one offer includes health insurance, NPS, and gratuity in CTC, another might exclude them entirely. Some even split variable pay across different months or tie it to performance. This lack of standardization makes it nearly impossible to predict your true monthly in-hand salary or tax liability — unless you know exactly how each component works.

That’s why I designed our CTC to In-Hand Salary Calculator — to let you input each component of your CTC exactly the way your offer letter presents it. Let’s break down every possible field you may encounter and guide you where to enter what.

| Component | CTC Field Type | How to Input |

|---|---|---|

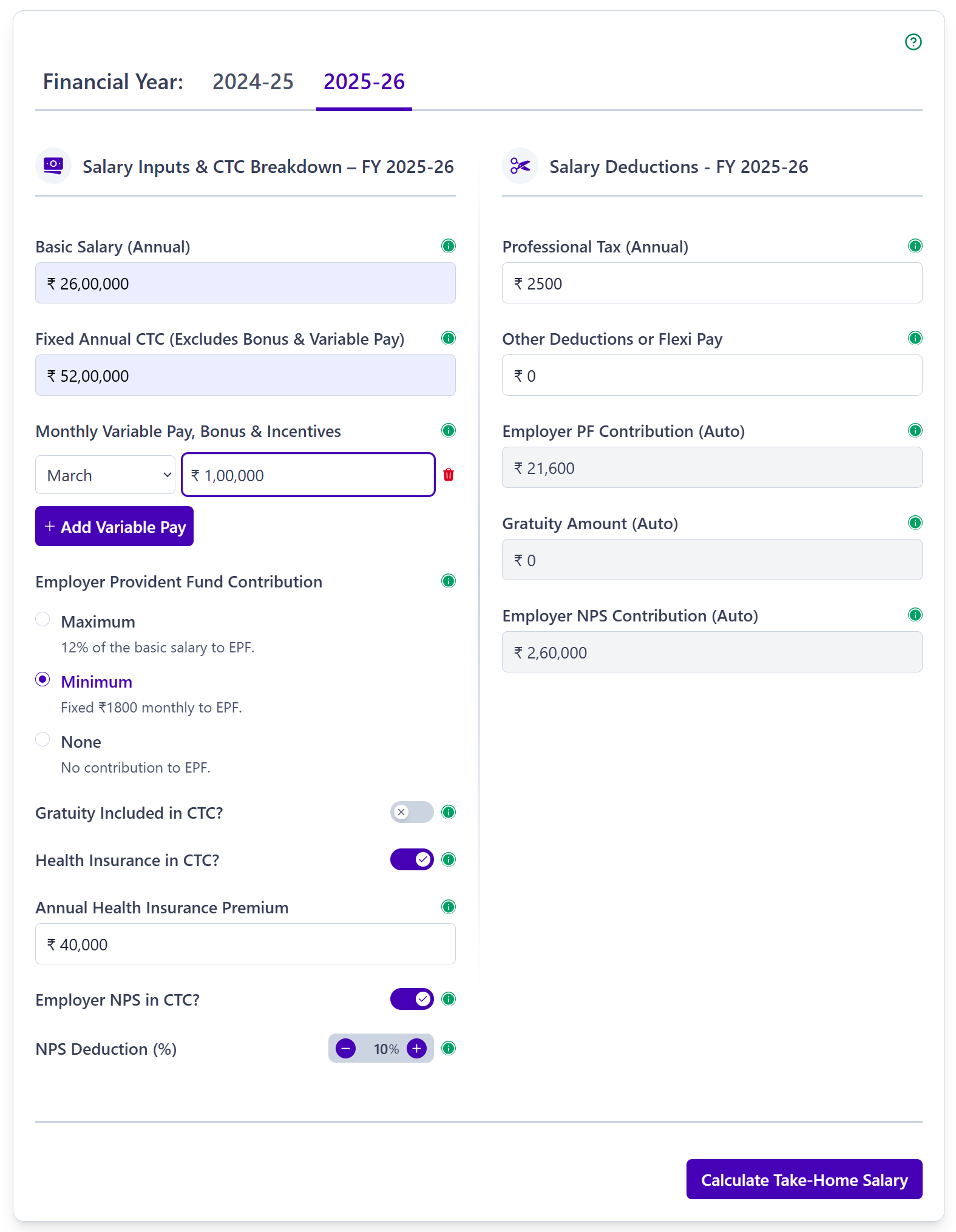

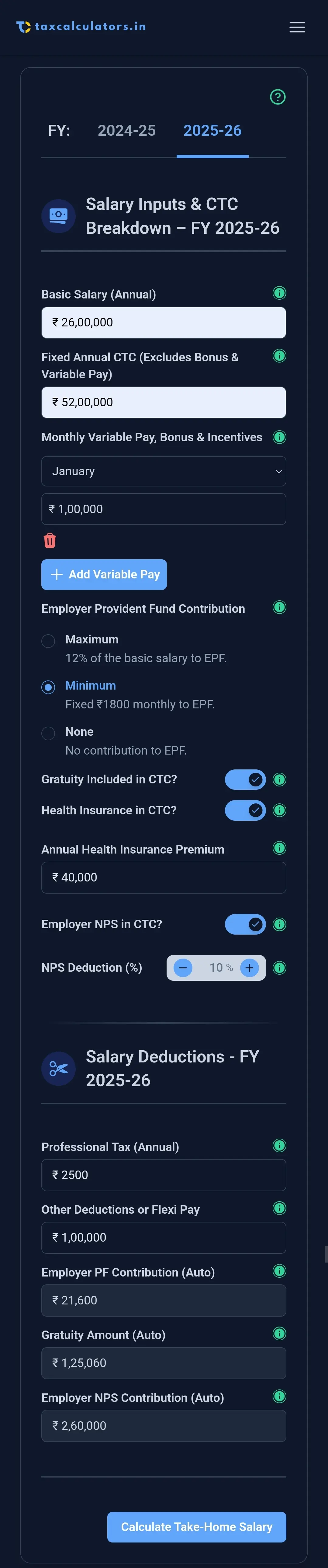

| Financial Year | FY 2025-26 | Select the financial year for which you want to calculate your salary. |

| Basic Salary | Fixed | Enter under Basic Salary (Annual). |

| House Rent Allowance (HRA) | Fixed / Allowance | Included in Fixed Annual CTC — no separate entry required. |

| Special Allowance | Fixed / Residual | Included in Fixed Annual CTC — no separate entry required. |

| Flexi Perks (LTA, Food, Fuel) | Allowance / Reimbursements | Included in Fixed Annual CTC — no separate entry required. |

| Personal Pay | Allowance | Included in Fixed Annual CTC — no separate entry required. |

| Variable Bonus | Incentive / Performance Bonus | Add under ‘Monthly Variable Pay, Bonus & Incentives’ — enter actual month-wise bonuses or appraisal payouts (e.g., March). Leave empty if bonuses or incentives are not part of your CTC. |

| Employer Provident Fund (PF) | Retiral Benefit | Choose one option in ‘Employer PF Contribution’: - Maximum: 12% of Basic Salary - Minimum: ₹1,800 per month (if Basic ≥ ₹15,000) - None: If PF is not part of your CTC |

| Gratuity (4.81%) | Retiral | Enable the ‘Gratuity Included in CTC’ toggle if mentioned in your offer. You can leave it off otherwise. |

| Health Insurance | Fixed / Perk | Enable the ‘Health Insurance Included in CTC’ toggle and enter the amount under Annual Health Insurance Premium. Leave it unchecked if not part of your CTC. |

| Employer NPS Contribution | Retiral | Enable the ‘Employer NPS in CTC?’ toggle and enter the percentage under NPS Deduction (%). Leave it unchecked if there’s no employer NPS contribution. |

| Total CTC | Actual CTC | Enter complete CTC in the Fixed Annual CTC field. |

| Professional Tax | Statutory Deduction | Enter under ‘Professional Tax’ in the Deductions section. It's usually not part of your CTC, but do check the annual professional tax applicable in your state. |

| Other Deductions | Deduction | Enter any tax-exempt deductions included in your CTC under ‘Other Deductions’ — e.g., flexi benefits, meal coupons, fuel reimbursements, leave encashment, etc. |

Financial Year

FY 2025-26

Basic Salary

Fixed

House Rent Allowance (HRA)

Fixed / Allowance

Special Allowance

Fixed / Residual

Flexi Perks (LTA, Food, Fuel)

Allowance / Reimbursements

Personal Pay

Allowance

Variable Bonus

Incentive / Performance Bonus

Employer Provident Fund (PF)

Retiral Benefit

- Maximum: 12% of Basic Salary

- Minimum: ₹1,800 per month (if Basic ≥ ₹15,000)

- None: If PF is not part of your CTC

Gratuity (4.81%)

Retiral

Health Insurance

Fixed / Perk

Employer NPS Contribution

Retiral

Total CTC

Actual CTC

Professional Tax

Statutory Deduction

Other Deductions

Deduction

Sample Salary Calculator Inputs – What Your Form Should Look Like

How to Read the Tax Summary – In-Hand Salary vs Deductions vs Tax

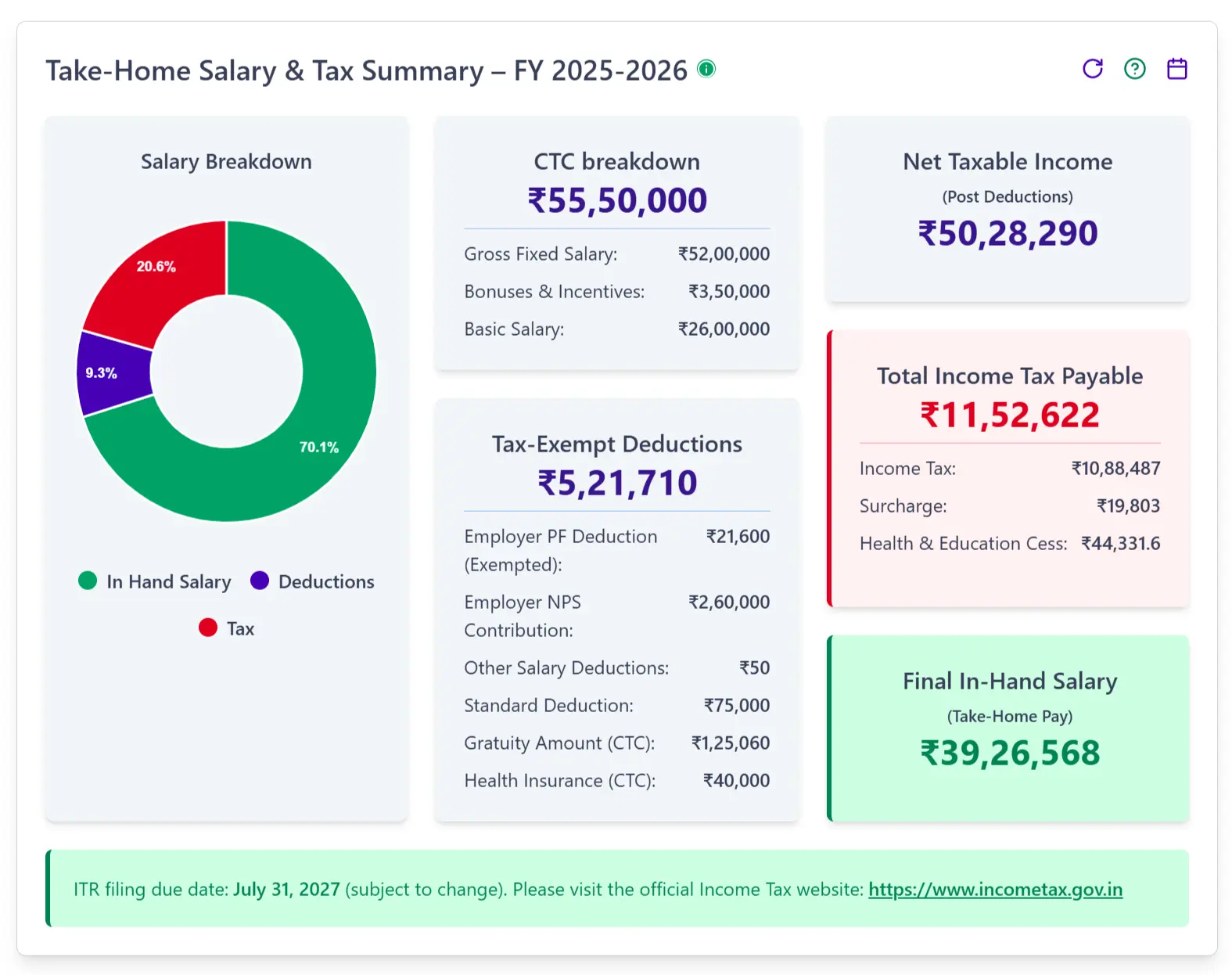

Once you’ve entered your salary details and selected the right CTC configuration, our Salary Calculator shows you a detailed breakdown of your in-hand salary, tax deductions, and taxable income — along with a clear summary of your total income tax payable under the selected regime.

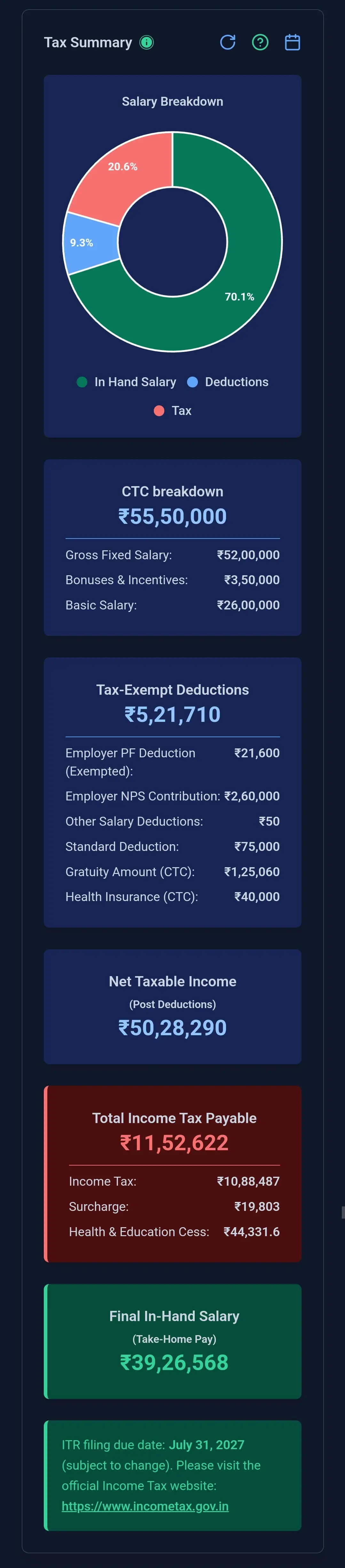

Salary Breakdown (Pie Chart)

The visual donut chart offers an at-a-glance overview of your salary structure:

- Green – Your final In-Hand Salary after all deductions.

- Red – Total Income Tax payable including surcharge and cess.

- Blue – Tax-exempt Deductions like PF, NPS, health insurance, etc.

Income Summary (CTC Breakdown)

- Total CTC: Your complete cost to company, including fixed pay and bonuses.

- Gross Fixed Salary: Excludes bonuses/incentives. It’s the core of your annual compensation.

- Bonuses & Incentives: Sum of monthly/annual performance-linked variable pay.

- Basic Salary: The base component used to calculate PF, gratuity, and HRA exemptions.

Tax-Exempt Deductions

These amounts are subtracted from your income before tax is calculated:

- Employer PF Deduction: Up to ₹1.8L exempt under Section 80C.

- Employer NPS Contribution: Exempt under Section 80CCD(2), up to 10% of basic.

- Other Deductions: Flexi pay, fuel, leave encashment, etc. (if applicable).

- Standard Deduction: ₹50,000 or ₹75,000 depending on regime and age.

- Gratuity: Exempt if included in CTC and employee is eligible.

- Health Insurance: Group health premium if part of CTC, exempt under 80D.

Net Taxable Income

This is your gross salary minus all tax-exempt deductions. It’s the amount on which your income tax is calculated.

Total Income Tax Payable

- Income Tax: Calculated slab-wise based on the selected regime.

- Surcharge: Applicable if income exceeds specified thresholds.

- Health & Education Cess: 4% of the income tax (including surcharge).

Final In-Hand Salary

This is your actual take-home pay after tax — what lands in your bank account annually. It reflects all salary, deductions, exemptions, and tax accurately.

Understanding Your Monthly In-Hand Salary Breakdown

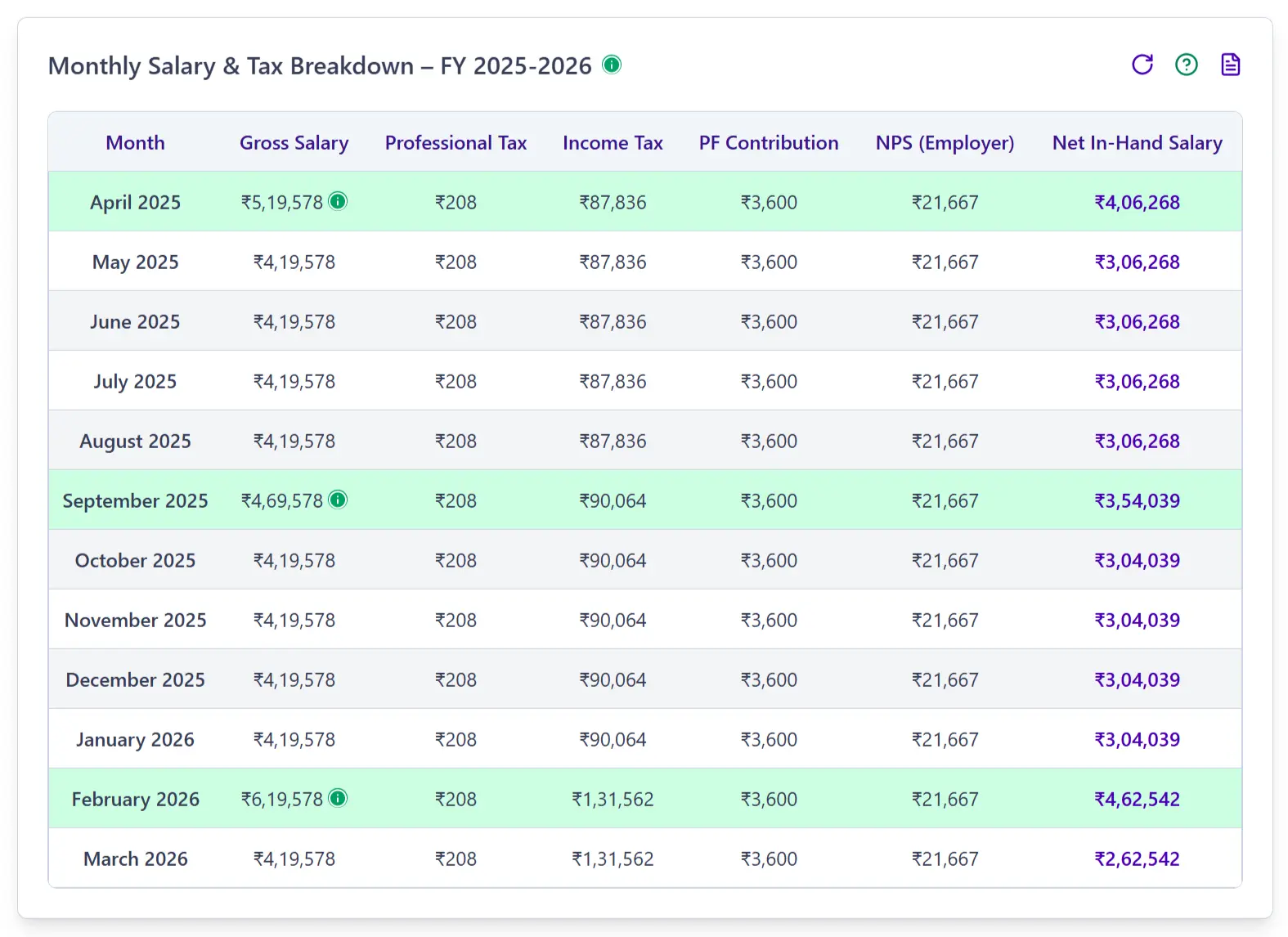

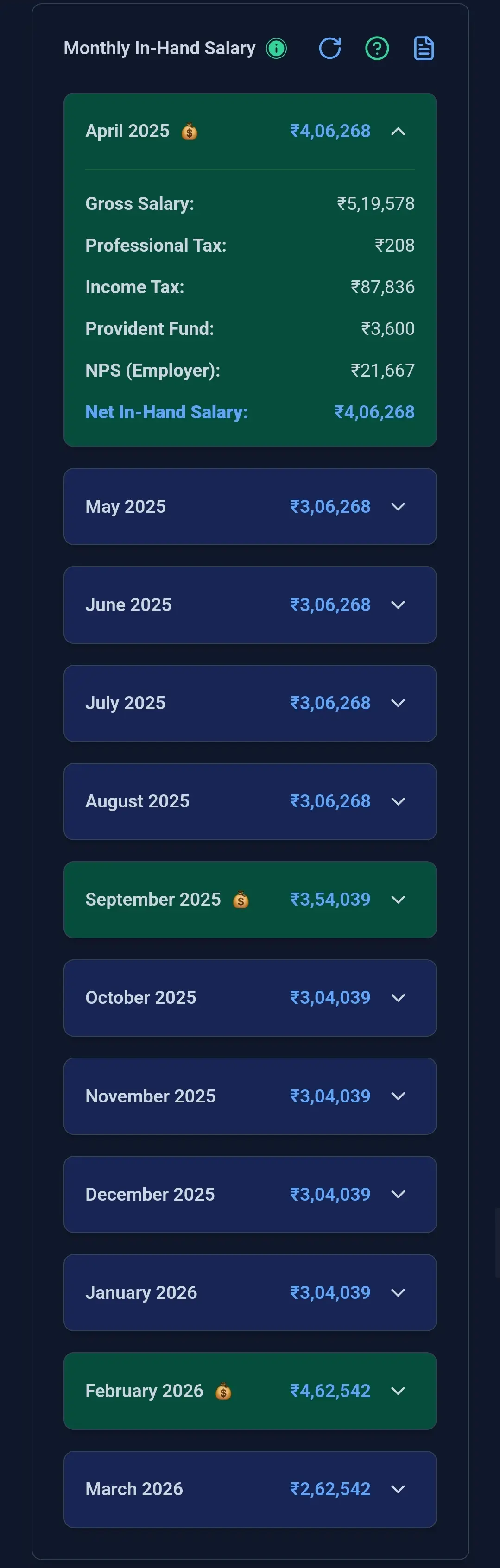

Once your annual salary and deductions are calculated, our Salary Calculator automatically provides a detailed month-wise salary and tax breakdown. This helps you track how your in-hand salary fluctuates across the year based on bonuses, tax, and employer contributions.

Bonus Months Are Highlighted in Green

In the table or mobile cards, rows highlighted in green indicate months where variable pay, performance bonuses, or incentives have been added. These spikes often occur in appraisal months like April, September, or February, depending on your input.

What Each Column Means

- Month: Each row represents a month in the selected financial year (FY 2025–26).

- Gross Salary: Total monthly salary before deductions, including fixed and bonus components if applicable.

- Professional Tax: State-level statutory tax deducted monthly. This may vary based on location.

- Income Tax: Your monthly tax liability, dynamically calculated based on your salary and regime.

- PF Contribution: Employee’s contribution to Provident Fund (₹1,800 or 12% of basic, based on your selection).

- NPS (Employer): Employer’s contribution toward NPS — exempt from tax and shown for transparency.

- Net In-Hand Salary: Final monthly take-home amount after tax and deductions. This is what hits your bank account.

Comparing Job Offers? Old vs. New Tax Regime

The fastest way to compare two offers isn’t headline CTC—it’s post-tax monthly in-hand. Run the calculator twice: once for Offer A and once for Offer B. For each offer, toggle between Old Regime and New Regime to see which structure produces the higher annual and monthly take-home. Focus on normalized months (exclude one-time joining bonus) for a fair comparison.

- Step 1: Enter Basic, Fixed CTC, and known variable months for Offer A; record annual net + average monthly.

- Step 2: Toggle PF/NPS/gratuity to match Offer A's structure; switch regimes to test differential.

- Step 3: Repeat for Offer B with its own breakup (different PF basis or higher variable component).

- Step 4: Compare resulting average monthly in-hand and retirement value (PF+NPS) accumulation.

- Decision Tip: Slightly lower take-home may still win if employer contributions (PF/NPS) + stability benefits are stronger.

If the difference between regimes is marginal (<₹2–3K/month) and your deductions are modest, the New Regime often offers simplicity. If Offer B pushes total deductions (80C + insurance + rent + potential NPS) beyond ~₹4–5L, model Old Regime carefully before deciding.

Common Mistakes When Calculating In-Hand Salary

Small input errors can distort your perceived take-home by thousands. Avoid these frequent pitfalls to ensure accuracy:

- Omitting Variable Pay: Forgetting quarterly or annual bonuses underestimates net and hides tax spikes.

- Mixing Employer vs Employee PF: Treating employer PF as cash-in-hand artificially inflates monthly salary; it is a deferred benefit.

- Ignoring Professional Tax: States levy it (e.g., Maharashtra, Karnataka); excluding it slightly overstates net each month.

- Using Annual Instead of Monthly Fields: Entering annual bonus into a monthly component skews distribution—always assign to the specific payout month.

- Not Toggling Gratuity: Including gratuity in take-home; it is a long-term accrual, not spendable monthly cash.

- Wrong Regime Assumption: Assuming Old Regime wins without totaling deductions; many 2025 profiles save more under New.

- Ignoring NPS Tax Treatment: Not accounting for extra ₹50K under 80CCD(1B) when modeling Old Regime can understate potential savings.

- Skipping Rent/HRA Logic: Entering HRA but not considering actual rent receipts caps exemption.

Double-check your offer letter and latest payslip while entering data. When uncertain, model with conservative assumptions (exclude uncertain bonuses) and then refine as details clarify.

How to Use FAQs

Refer to your offer letter and enter each component in the matching field — like Basic Salary, Fixed Annual CTC, and bonuses in Monthly Variable Pay. You can use toggles for PF, gratuity, NPS, and insurance if included in your CTC.

Click on ‘Add Variable Pay’ in the calculator and input the bonus month and amount. This ensures months like April, September, or February reflect the correct spike in your take-home salary.

Simply disable the toggles for PF, gratuity, or insurance. The calculator will exclude these from the deduction and in-hand salary logic automatically.

Use the calculator for each offer by entering the respective CTC breakup and tax regime. You’ll get an accurate in-hand salary for each, making offer comparisons more transparent.

If your employer lets you choose, you can toggle between regimes in the calculator and see which gives you a higher in-hand salary after deductions and tax.

Scroll to the Monthly Salary Breakdown section after calculation. It shows gross salary, income tax, professional tax, PF, and NPS for each month, along with your exact take-home salary.

Green rows indicate months where bonuses or incentives were added. These are typically months where your salary spikes due to variable payouts entered earlier.

If these are included in your total CTC and are tax-exempt, add them under ‘Other Deductions or Flexi Pay’ in the Deductions section to reduce taxable income.

Yes. Start with Basic Salary and Fixed Annual CTC. Other fields are optional and can be adjusted as you learn more about your compensation structure.

At the top of the calculator, select the relevant financial year — for example, FY 2025–26 — before entering your salary details. The tax rules update accordingly.